Canaan Is A Buy (NASDAQ:CAN)

jiefeng jiang/iStock via Getty Photographs

Canaan (NASDAQ:CAN) emerges as a promising laptop or computer components/cryptocurrency mining stock. The company’s know-how in the built-in circuit field and its speedy time-to-current market has presented the business an early industry advantage vs. its opponents. In addition, the laptop components market and cryptocurrency mining market are here to stay with high growth prospective buyers. This presents Canaan options to broaden its business and improve its operations, indicating a purchase prospect for this undervalued computer hardware inventory.

Small business Overview

Headquartered in Beijing, China, Canaan is a tech firm that layouts and develops application-particular built-in circuit, ASIC, chips. The firm works by using the chips for their Bitcoin mining devices and Artificial Intelligence applications as Canaan is one of the foremost producers of Bitcoin mining devices in the entire world.

Bitcoin Mining Devices

A vast majority of the ASIC chip programs is committed to the improvement and creation of the company’s ASIC-based Bitcoin mining machine which are sold under the AvalonMiner manufacturer. These devices are marketed to shoppers in the United States, Germany, South Korea, and many other international locations close to the environment. With frequent technological advancement and study, Canaan generally introduces a new series of Bitcoin mining equipment each individual yr and incorporates the hottest ASIC chip models and processing technological know-how. These devices accounted for 64.4% of Canaan’s overall revenues in 2021.

AI Apps

Through its working experience with the developments of the ASIC chips for Bitcoin mining, Canaan has been equipped to develop its AI chips which are scaled-down in measurement, have elevated electrical power performance, and have increased computing electricity. These chips deliver AI remedies in the discipline of Internet of Items, IoT, with its equipment vision and hearing qualities which contain picture classification, deal with detection, and speech recognition.

Field Evaluation

Personal computer Components Business

The computer system components marketplace is a big worldwide sector with frequent significant demand from customers. It is made up of profits of personalized pcs, laptops, computer system storage gadgets, and peripheral equipment like computer chips. As of 2021, it is valued at all over $1,129.39 billion and it is predicted to attain $1,568.25 billion by 2026 with a compound annual growth amount, CAGR, of 6.6%. As the entire world turns into extra and much more electronic, there will be a advancement in investments in new systems this kind of as clever cities, good cars, and synthetic intelligence. These systems are enabled by IoT. This expansion in new tech investments is likely to be one of the key drivers for the laptop components market in the coming a long time. Significant corporations in this space these types of as Apple (AAPL), Dell Technologies (DELL), and Intel (INTC) have by now begun to spend in the growth of these clever systems.

Cryptocurrency Mining Sector

The cryptocurrency mining current market is a new and emerging current market that has arrived at a dimensions of $4050.5 million in 2020 and it is predicted to access a dimensions of $4502.4 million by the conclusion of 2026, with a CAGR of 2.7%. The most important driver of this development is the massive raise in desire for cryptocurrencies, primarily with the increase of non-fungible tokens, or NFTs.

To comprehend far more about this market place, we initial have to have to know what cryptocurrency mining is. Cryptocurrency mining is generally the verification of transactions on the respective blockchain, based on the cryptocurrency. The folks who verify these transactions are known as miners and in order to validate the transactions, these miners want to total some job. The strategy by which Bitcoin and other massive cryptocurrencies use is that the miners need to address a sophisticated cryptographic puzzle to be able to verify transactions. The only way to fix the puzzle is to attempt all achievable combos and permutations which will take a large amount of computing ability, but when the puzzle is solved, the miners can confirm transactions and generate some crypto in return for their perform. This system has turn into a very important component for the cryptocurrency ecosystem.

As talked about just before, cryptocurrency mining can take up a lot of computing electric power and with prices these kinds of as electric power going up, it would not support with the now superior operational prices for cryptocurrency mining. This is a main barrier to entry for new crypto mining startups as a lot of of the large corporations in the area these kinds of as Bitfarms (BITF), Hive Blockchain Technologies (HIVE), and Hut 8 Mining (HUT) have now built significant investments into new services/warehouses and technologies to raise the effectiveness of the mining approach and decrease the computing costs.

Competitive Edge

Inspite of the hard opposition in both equally the personal computer hardware market and the cryptocurrency mining sector, Canaan’s mastery of the built-in circuit design as very well as its quickly time-to-industry

with its products and solutions gives the firm a competitive edge versus its rivals. The Canaan workforce is very experienced in circuit and digital unit designs with Nangen Zhang top the group as CEO. Mr. Zhang himself has above 11 decades of experience in electronic gadget style, producing, and analysis and growth.

Below Zhang’s leadership, Canaan has designed some technological breakthroughs in their ASIC chips these types of as reduced voltage electric power effectiveness and increased computing density which are incredibly essential for crypto mining. The company’s rapidly time-to-market with its goods has led to the early monetization of its ASIC chip styles for the Bitcoin mining devices offering Canaan an early current market edge. In addition, Canaan has secured multiple long-phrase partnerships with unique top world wide suppliers, letting them to provide high-high quality products in a well timed manner.

Financials

Yahoo Finance

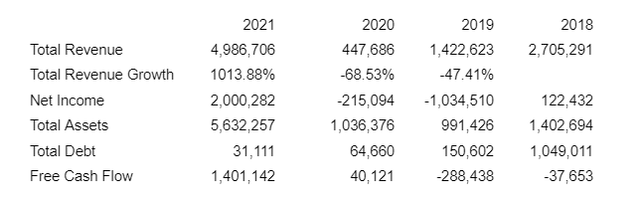

When seeking at its financials, we can see that Canaan was just one of those corporations that was strike very tough by the COVID-19 pandemic. With heaps of provide chain disruptions and delays, the enterprise just could not supply on time and satisfy purchaser calls for with its ASIC chips, primary to a drop in revenues and a reduction of its profitability involving 2019-2020. Nonetheless, when the pandemic started to abate and generation started out to improve, Canaan’s product sales started out to raise. This, along with the latest growth of the NFT industry and hype, has led to a earnings improve of over 1000% percent between 2020 and 2021.

The firm’s asset pattern is pretty related to its income trend with dips between 2018 and 2020 and big expansion in between 2020 and 2021, but its full debt has been consistently decreasing about the past 4 decades which is very healthier. Its recent D/E ratio is .90. This will make it much easier for Canaan to get loans to set towards R&D to proceed developing its ASIC chips for equally Bitcoin mining equipment and AI applications.

Long term Expansion Chances

Bitcoin Mining Business enterprise

Possessing mastered the ASIC chip structure as perfectly as being 1 of the principal producers of Bitcoin mining devices, Canaan has the opportunity to enter the Bitcoin mining company relatively than just advertising the equipment. Getting into the Bitcoin mining business can be difficult and highly-priced, but Canaan has currently secured collaborations with distinct cryptocurrency mining farms. In addition, their low voltage and substantial computing density chip helps Canaan to mine considerably far more effectively.

Maximize Production Ability

Yet another possibility that I see for Canaan would be to raise its creation capability. As the cryptocurrency mining current market proceeds to improve at large charges, the demand for equipment will probable comply with that development. As the corporation boosts output ability, it is equipped to keep up with the desire for its items, mitigating the possibility of underproducing and escalating expenditures/shedding profits.

Valuation

Yahoo Finance

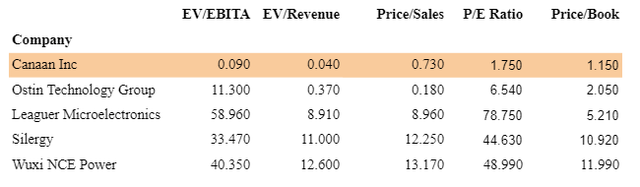

When as opposed to its competitors, we can see that Canaan Inc is undervalued on pretty much all the valuation metrics.

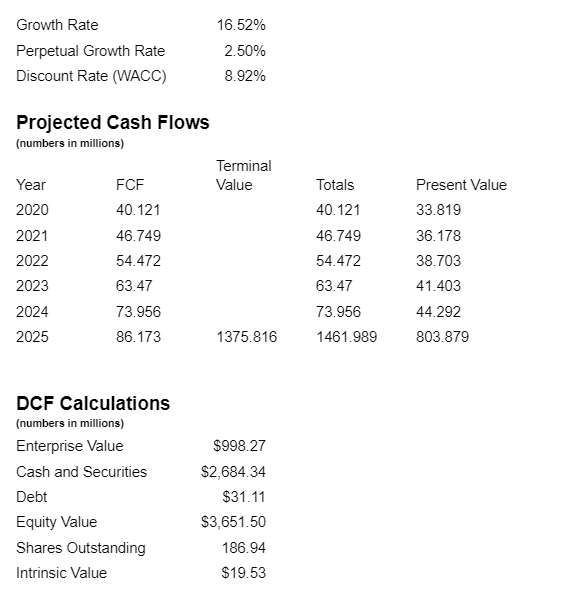

In addition, I have performed discounted hard cash circulation evaluation of the stock. For the development price, I have applied a CAGR of Canaan’s revenues for the past 4 years. The perpetual advancement charge is preferred in between historic inflation charges of 2-3% to match the financial system progress and as for the price cut price, I used the firm’s weighted typical value of capital. I have resolved to use the company’s totally free hard cash movement in 2020 as an alternative of 2021 because the growth in FCF between these two decades was unnaturally substantial. By using the FCF from 2020 as a substitute of 2021, it permits for a a lot more all-natural expansion and can help make the DCF investigation extra precise.

Calculations carried out by writer

Hazards

Higher Dependence on Bitcoin

A large part of Canaan’s profits are from its Bitcoin mining devices. The buying actions of Bitcoin miners is primarily pushed by the financial returns of Bitcoin mining which normally depends on Bitcoin’s selling price. An boost in the price of Bitcoin would provide a even larger incentive for mining and vice versa. With Bitcoin getting as volatile as it is, Canaan’s pricing technique and gross sales could be unpredictable. In addition, other factors such as electricity expenditures and the charge effectiveness of mining machines can influence the Bitcoin mining business. If there was a shortage of power provide or raise in energy expenditures, that would increase expenses of Bitcoin mining, lowering demand from customers for the devices.

Bitcoin’s present-day rate is all over $22,000, which is 1-3rd of its all-time significant of $68,000 again in November 2021. This large cost drop previously places a toll on Canaan’s small business model and its demand from customers for its Bitcoin mining machines as very well as its long run Bitcoin mining enterprise. This helps make it pretty vital for Canaan to diversify its revenue streams to stabilize its revenue flow due to the fact a major portion of the company’s profits will come from promoting these Bitcoin mining machines. What the company could do is to tap into distinct industries and markets.

Due to its customized programming, compact size, and significant reliability, the ASIC chip is very preferred amongst intelligence organizations, space systems, and defense techniques. Canaan could capitalize on this possibility to create ASIC chips that are not entirely directed in the direction of the Bitcoin mining equipment. I consider that the selling price of Bitcoin and other cryptocurrencies will bounce back again in the subsequent yr or so but even now, amidst the uncertainty of the entire cryptocurrency market place, this new possibility gives a way to make regular and secure earnings.

Intercontinental Trade Guidelines

Since China has banned cryptocurrencies, Canaan has to export their products to quite a few various nations around the world about the world. Alterations in trade boundaries and trade guidelines wo

uld negatively have an effect on the company’s operations. Lately, the United States, which has a significant buyer base for Canaan’s products, has advocated for bigger trade limitations and boosts in tariffs, specifically on merchandise from China. This places threat on the company’s gross sales and revenues.

Government Regulation

In buy for Canaan to run proficiently, it requirements to acquire diverse approvals and certificates. These may include intellectual assets, to keep the uniqueness of their ASIC chip styles, or government licenses. Complying with these restrictions involves sizeable expenditure, rising working costs. In addition, failure to acquire all important licenses and approvals would lead to additional fines or even suspension of functions.

Summary

I would level Canaan as a purchase with a selling price target of $19.53 Despite tough competitiveness in its respective marketplaces, Canaan has demonstrated that it is capable to supply large high quality ASIC chips for equally Bitcoin mining and AI programs in a well timed method. We could finally see Canaan rise again even higher than its value goal to its all-time higher of $34.60.