Vroom Stock: At $1.50, A David Tepper-Type Opportunity (NASDAQ:VRM)

Apriori1/iStock via Getty Images

As someone who has been at this game for north of 20 years, both formally and informally – so think the buy side and investing/ speculating in my PA (personal account) – nothing activates and heightens the senses like a bear market. They bring exceptional bargains that wash up on the shoreline amidst the shipwrecks which invariably occur during these periodic, unexpected and violent storms on the high seas. This is a time where your thought process has to be so crisp, your focus so sharp, and your emotions so measured and in check. Literally fortunes are made and lost during these infrequent bear market time periods.

Today, I write to share a setup that is both compelling and asymmetric. Upon considerable reflection, I elected to share it on SA’s free site, in real-time, as a would-be victory lap, perhaps six months from now, won’t be well received (should my thesis actually play out, and it very well might not).

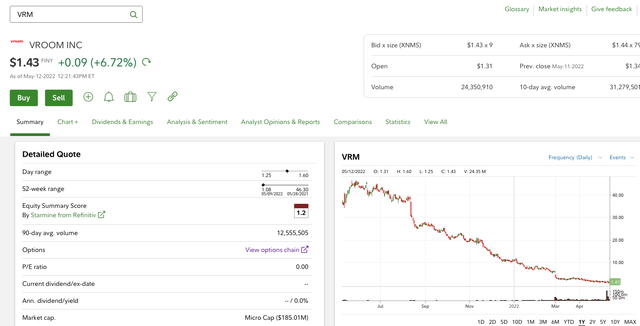

The opportunity in question is Vroom, Inc. (NASDAQ:VRM). Quite frankly, the market is pricing the equity as if bankruptcy is just around the corner and as if the proverbial wolf is at Vroom’s door. During periods of exceptional turmoil and tumult, like the present time with the Nasdaq down 27.4% (YTD through May 11, 2022), markets simply lose their ability to correctly and properly price in bankruptcy risk and accurately value any equities deemed too risky for respectable men and women to place into their portfolios.

Fidelity

Lo and behold, this past Monday night, Vroom reported its Q1 FY 2022 results and offered detailed guidance. Equally as important as its granular guidance was the most welcome and long overdue clarion call to Wall Street that its new CEO, Tom Shortt, and his team found religion, and its sound pivot is in motion.

Let’s start with valuation, so I can explain why I say the market is incorrectly pricing in bankruptcy risk, at least at $1.45 per share. Vroom has about 138 million shares outstanding. At $1.45 per share x 138 million shares, we are talking about a market capitalization of only $200 million for the equity. At its peak, Vroom shares briefly eclipsed $70 per share. So we are talking about north of $9.6 billion of equity valuation that disappeared. As for its balance sheet, and I am excluding its recently acquired UACC unit (they bought this for $318 million in February 2022), essentially, Vroom’s only long term debt is a $625 million 0.75% convertible bond.

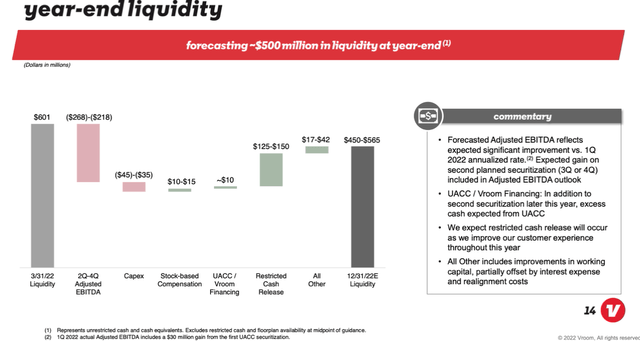

What is fantastic is that management provided this detailed bridge as to its targeted 2022 year-end unrestricted cash balance.

Enclosed below, management guided the street to $500 million of unrestricted cash. In other words, that is $3.62 per share in unrestricted year-end 2022 cash, despite what management projects as big operating losses during the remainder of 2022, as they completely re-align the business.

Vroom Q1 FY 2022 IR Deck

Qualitatively, and if people are intellectually curious enough then I highly encourage them to either listen to Vroom’s Q1 FY 2022 conference call or read the transcript.

And by the way, Tom has a good track record, and experienced business success during his career, and arguably in much more complex and multi faceted roles, such as his time in top global supply chain spots, at both Home Depot (HD) and Walmart (WMT). As Bill Gross once said in one of his monthly notes (remember, my buy side experience was in IG fixed income, so I used to read Gross), circa the late 2000s, back when he was the King of PIMCO, sometimes you need the perfect jockey for when it is raining and the track is sloppy. Well, Tom Shortt sure looks like a good mudder.

Without getting too deep in the weeds, let me share why I am so qualitatively excited about Vroom shares, notably at its current valuation.

The Genesis Of All Vroom’s Problem And Breathtaking Cash Flow Losses Was Chasing Unattainable Triple-Digit Growth

On the Q1 FY 2022 call, if you can synthesize and pick up on subtext, it was crystal clear that Vroom made a number of unforced errors. The most glaring and obvious one was chasing unattainable and unprofitable triple-digit revenue growth. Frankly, the market was shouting at Vroom for quite some time that this was the elephant in the room, and it took a near-death experience for Vroom’s board to find religion. Moreover, its Executive Chairman, Bob Mylod, was super candid and forthright on Vroom’s shortcomings and how they already have and will continue to course correct.

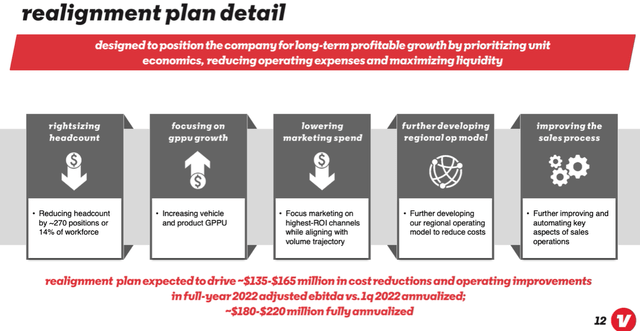

Here is a snapshot for Vroom’s realignment plan.

Vroom Q1 FY 2022 IR Slide Deck

However, let me quickly share a few excerpts about how egregious and how far off course this chasing of that elusive triple-digit revenue growth led them.

(All quoted material is from the Q1 FY 2022

Conference Call)

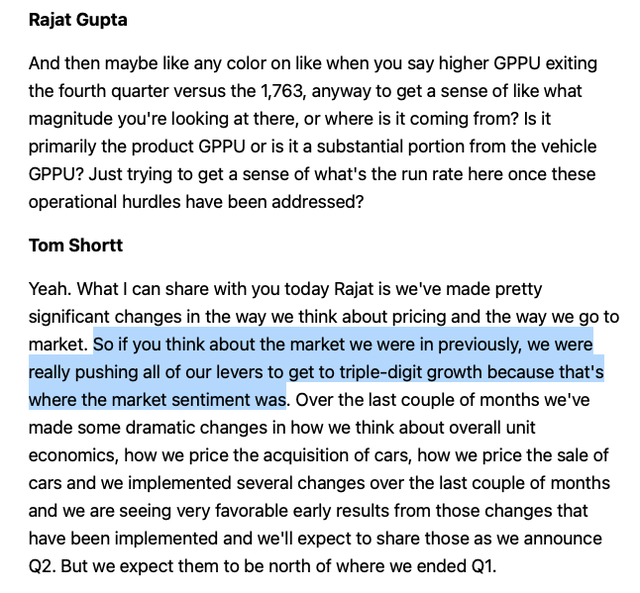

Exhibit A

JP Morgan’s analyst, Rajat Gupta, asked a series of super long and skeptical questions (he has been skeptical on prior calls, too). On the third or fourth Q&A exchange – I lost track given the length of Rajat’s questions – Tom made the Freudian slip. The new CEO, Tom Shortt, revealed to the market and the world that Vroom’s old skipper was intentionally burning a ton of cash with the nonsensical goal of achieving the unattainable goal of triple-digit growth! See below (emphasis added here and in later excerpts):

Vroom Q1 FY 2022 Conference Call

Exhibit B

Here is a poignant example of badly this business was run, again, all in the myopic mindset of achieving triple-digits growth.

Think about how silly this is (see below). You are selling someone a Vroom vehicle in the Southeast, but you are shipping it from your inventory in Seattle!

Vroom Q1 FY 2022 Conference Call

Exhibit C

This is Bob Mylod’s – the Executive Chairman – opening remarks. He is very forthright that the underlying cause is chasing an unachievable goal of triple digit growth. The growth was so fast that Vroom couldn’t handle the important aspect of getting the titling and registrations right. The most basic blocking-and-tackling element of this business.

I’d like to acknowledge that the past several months have not looked very much like winning. We know we fall into an ever increasing bucket of companies that had attracted significant investor interest despite large losses because the markets were less focused on the pursuit of profit in exchange for delivering fast growth and large market share gains.

Valuations of companies with that business profile has been decimated this year and the market is very clearly demanding much near-term visibility to profitability. We know full well that Vroom is squarely in this bucket. But to be clear, while we know that much of our valuation has to do with these macro market forces, we also know we have a lot of work to do on improving our operational execution. As in recent months, we have come up short in delivering a delightful experience to each and every one of our customers.

Many of our challenges have revolved around the titling and registration of the cars that we buy and sell to and from our customers. We have always known that this is a tedious process one which requires a symphony of well-orchestrated handoffs from the many participants involved. The buyers, the sellers and the many consumer finance companies that lend to our customers, our floor plan lender and of course, state DMVs each with their own local rules and procedures that continue to evolve throughout the pandemic.

It is manual and time-consuming. In the past several months, with the hyper growth of our business putting more and more strain on this important operational motion and recent developments in the way our partners handle this paperwork, we fell behind. The result has been too many customers that have bought cars from us and who have not been able to register their cars in a timely manner prior to their temporary license plates expiring.

When this occurs, those customers are left with a car that they bought from us, but which they might not be able to drive. That is an unacceptable outcome for even one single customer yet alone the many that this has happened to. It has also put a strain on our relationships with the various states DMVs on who we and our customers rely to process our title and registration requests.

And of course, it impacts our financial performance. It lowers inventory turns and increases the likelihood of markdowns. It increases customer returns or customer make good payments, which are harmful to gross margins. It also increases operating expenses associated with customer service calls or our employees making repeated efforts to obtain titles and tags.

Finally, just to wrap up the conference call, the subtext from Tom Shortt was that the FY 2022 guidance was conservative as it bakes in a lot of macro headwinds.

The Other Big Reason I Am Bullish

If you look at the stock prices of both Carvana (CVNA) and Vroom, the market is looking at recent cash flow burn rates and extrapolating them out for years into the future. I would argue that what the market is missing or underappreciating is that the biggest headwind to both Carvana and Vroom besides chasing unprofitable triple-digit growth (no longer the case for Vroom) is that the chronic shortage of chips for automobiles is far and away the biggest factor that has dramatically curtailed auto production by the OEMs. As a result, auto production is in the 13 million unit range instead of the 17 to 18 million unit range, a range that the market is and has been demanding. This in turn has led to very tight used car inventories, as there is natural wear and tear and tangible end of life cycles for used cars.

However, there are encouraging, albeit early, signs that part of the chip shortage was caused by hoarding, and businesses trying to get in front of the steep chip inflation. Lo and behold, check out this April 25, 2022 Reuters article suggesting that the recent drop in high end computer chips suggests some of the shortages were, in fact, caused by hoarding. Moreover, holding excess stockpiles of appreciating assets is one thing, but hard to explain to the Chief Technology Officer when stockpiles of chips are dropping rapidly in price.

Lastly, the global chip makers have earmarked tens of billions of dollars, if not north of a $100 billion, in new Capex and new capacity to meet this once-considered insatiable demand. There is an inherent lag, but rested assured that new capacity will arrive.

As Tom, and Vroom’s team, are smart people, the intentional slowing down of the business’s growth is not only the right thing to do for the business, and for its longevity, but it’s good timing, as the used car market cycle could look much better when OEMs ramp up production and replenish empty dealer lots throughout the country.

Putting It All Together

As for my slightly provocative title, invoking the great David Tepper by name, I will explain it. Working on a buy side bond desk, during the height of the financial crisis, afforded me a front row seat as I watched as David masterfully loaded the boat on Bank of America (BAC) and Citigroup (C) preferred stock at $0.10 to $0.20 on the dollar. I distinctly recall him, close to real time, saying his firm was very often one of the only firms on the bid side, for a period of time.

Although, scooping up BofA and Citi preferred stock, at deeply discounted levels, again during the pinnacle of the financial crisis, is kind of apples and pineapples, I would argue that deeply discounted equities (incorrectly priced for bankruptcy) have the commonality of being a fruit, just like those preferreds. Essentially, I would argue that you need to have cunning as a fox, like David Tepper, to see an asymmetric opportunity, like Vroom shares, currently trading at roughly $1.50 per share.

You have a company that has found religion, has a new and sound reboot plan, should have $500 million in unrestricted cash, at year-end 2022, and there is no near-term mechanism to force them into bankruptcy. The company’s only long-term debt is $625 million of 0.75% 2026 convertible notes. In other words, the market is mis-pricing the inherent would-be equity optionality and upside to scenario should a turnaround transpire. Moreover, if I’m right that the auto chips arrive, perhaps by late 2022, and the OEMs crank up production, then the used car cycles and both Vroom and Carvana’s businesses could look dramatically better than circa May 2022.

As for risks, you have execution, macro, and how long it takes for the OEMs to get their hands on those much needed chips.